Getting started

Authorization process

Regulations of the Trans.eu Platform

untitled article

How to get access to TFC/TFF and CargoON

Basic information

Company account

Employee accounts

Logging into the account

TransID

Overview of modules for Forwarders

Overview of modules for Carriers

Overview of modules for Shippers

Messenger

Messenger functions

Messenger settings

Contact groups in the Messenger

Negotiation and acceptance of offers in the messenger - forwarders (TFF) and CargoON

Negotiations and acceptance of offers in the Messenger by the Carrier

Information in the chat window that the caller is on the debt exchange

Conversation archive

Decision panel

Decisions to be made module

Decisions to make - confirmation of the transaction

Decisions in the Panel - Accepting a fixed route

Freights

Management of sent freights

The freight archive

Payment term for a freight

Import of freights from a CSV file

Freight templates

Multifreight - handling the function by the contractor

Multifreight - handling the function by the carrier

Forms of freight settlement

Bulk actions on freights

Limited quantity

Creating a freight offer for bulk materials

Freight Negotiation Management - Principal

Quick Filling - how to use automatic freight creation

Internal negotiations in the company publishing the freight

Loads exchange

Add a freight offer

Delete freight offers

Searching for offers on the freight exchange

Filter load offers

Editing filters

Search for freight offers on the map

Cost calculation on the Load exchange

Alerts before entering into cooperation

Pop-up menu in the exchange offer table

Offers received from a private exchange

Private freight exchange for forwarders

Humanitarian aid

Direct offers - Carrier

Invitations to Private Exchange with a CSV file

Operations at customs clearance points

Block direct offers from selected users

Direct offers as a principal

Concluding transactions - carrier

Concluding transactions - contractor

Vehicle exchange

Add a vehicle offer

Deleting a vehicle offer

Search for vehicle offers

Calculation of route costs

Adding a contact person in the vehicle offer

Additional functions of the Vehicle Exchange

Dashboard and Widgets

Dashboard - basic information

Widgets - basic information

Unrated transactions widget

Negative ratings issued

Widget - Ratings

TransRisk Widget

Transparency rate widget

Active offers widget

Method of publication efficiency widget

Freights in progress widget

Most common directions widget

Last posted load widget

Missed opportunities widget

One-Sided Transaction Confirmation Widget

Performance level widget

Budget overview widget

Responses widget

TransBarometer widget

Accepted freights widget

Arrival time prediction widget

Loading/unloading schedule widget

Orders funnel widget

Most active carriers widget

Top carriers widget

Punctuality rate widget

Orders amendments widget

TransInfo Widget

Bans widget

Border Traffic widget

Diesel fuel prices widget

Euro exchange rate widget

My activity widget

SDR calculator widget

Trans alert widget

What's new? widget

Dock Scheduler - Warehouse occupancy widget

Dock Scheduler - Warehouse occupancy level widget

Dock Scheduler - Daily status widget

Dock Scheduler - Average operation time widget

Dock Scheduler - Delay types widget

Dock Scheduler - Warehouse utilization widget

Transports in realization

FAQ - Visibility Monitoring

Functions and use of the Transports in realization module

Handling the freight with monitoring as a client

Handling freight with monitoring as a contractor

Handling freight and order with monitoring as a client

Handling freight and order with monitoring as a contractor

Map view

Badges for carrier

Notification and incident panel

Handling bookings in the Transports in realization module

Settings in the Transports in realization module

Sharing monitoring

Orders

Create a new order

Handling orders as a contractor

Handling orders as a carrier

Settings and Order template

Archive of orders

Automation of the request for entry execution data before sending order terms

Changing order arrangements after acceptance as a contractor

Changing order arrangements after acceptance as a carrier

Adding and verifying additional costs

Adding and verifying attachments

Maps

Schedules

Navigation in the Schedules module

Warehouse management

Dock management in the warehouse

Time slot management

Booking management

Booking templates

Booking blocks

Handling attachments in bookings and time slots by the shipper

Providing weights during booking

Sharing a time slot with a user from outside the Platform

Booking manual for the Storekeeper

Booking manual for the Security Guard

Employee roles in the Schedules module

Import of time slots and bookings

Virtual Queue Management

Forwarding booking - shipper

Bookings

Received bookings and time slots

Booking in Loads4DRIVER - instructions for the driver

Employee roles in the Bookings module

Contractors

Functions of the Contractors module

Adding a company to contractors

Invite a company to cooperation

Creating groups of contractors

Suspending cooperation with a contractor

Fixed routes

Functions of the Fixed route modules

Fixed routes with carriers

Fixed route price/rate settings

Balancing types

Fixed route management

Publication of freight offer to a fixed route

Fixed routes with shippers

Freight offers on fixed routes

Surcharge templates

Fuel surcharge

Weekday surcharge

Pallets exchange surcharge

Surcharge for additional operation point

Automation rules

(CargoON) Shipper Automation rules

Adding an automation rule

Publication of freight and searching for carriers using a rule

Automation rule settings

Invoices

Fleet

BI Reports

Reports - general information

Freights Overview report

Performance report

Type & activity report

Carrier activity report

Freights list report

Benchmark report

Directions report

Savings Management report

Negotiations report

On Time In Full (OTIF) report

Orders list Report

Report - Carrier On Time (Dock Scheduler)

Operation timeline report (Dock Scheduler)

Warehouse utility report - Dock Scheduler

Time slots (Dock Scheduler) report

Booking List (Dock Scheduler) Report

Ratings and References

Functions of the Ratings and References module

Issued ratings

List of ratings in the exchange offer line

Payment statuses

Received ratings

References

Sending a request for references

FAQ about ratings

Additional services

Financial services

Payments

Settings

Trans.eu Platform notifications and sounds

Change of the Platform language

untitled article

Address book

Report a suggestion or problem form

TransRisk

(TFC) Carrier TransRisk - an independent indicator of payment credibility

(TFF) Forwarder TransRisk - an independent indicator of payment credibility

(CargoOn) TransRisk - an independent indicator of payment credibility

Body

Mobile application

Installation and download of the Loads2GO application

Searching for load offers in Loads2GO

Search for vehicle offers in Loads2GO

Filtering freight offers in Loads2GO

(TFC - Carrier) Negotiation and acceptance of the offer in Loads2Go

(CargoOn) Negotiation and acceptance of the offer in Loads2Go

Add a vehicle offer in Loads2GO

My vehicle offers in Loads2GO

Messenger in Loads2GO

Notifications in Loads2Go

Edit your profile in Loads2GO

You are here All categories > TransRisk > (CargoOn) TransRisk - an independent indicator of payment credibility

(CargoOn) TransRisk - an independent indicator of payment credibility

Updated 2 years ago

by

Jakub

Updated 2 years ago

by

Jakub

What is the TransRisk indicator?

TransRisk is an indicator of a company's payment credibility, which presents the current situation of the company and aims to facilitate risk analysis and make decisions regarding cooperation with contractors. It is a dynamic product whose algorithm calculates daily data from several sources.

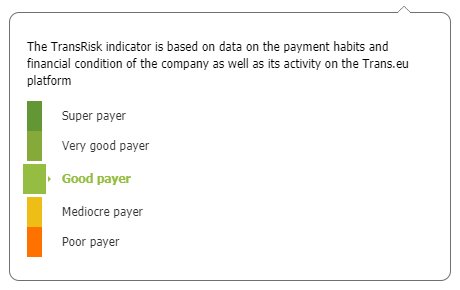

TransRisk is displayed on a 5-point scale:

- Super payer,

- Very good payer,

- Good payer,

- Mediocre payer,

- Poor payer.

How does it work?

To ensure product dynamics and indicate the current situation of the company, the final result is mainly influenced by data from the last 60 days. In this case, we are talking primarily about data coming directly from the Trans.eu Platform. However, the algorithm also includes data from external sources, such as e.g. credit rating agencies. On the other hand, companies that want to take care of their credibility can also provide the latest data about their business to the algorithm.

The most important factors affecting TransRisk are:

- Payment habits (debt exchange, debt collection cases),

- Activity on the Trans.eu Platform (transactions concluded, evaluations received),

- Financial data (current indicators and trends of changes, financial security),

- Relations (capital and personal),

- Basic data (including legal form, internship on the market, internship in Trans.eu).

Although the ratings from contractors affect TransRisk, it is worth to notice that this is only one of many factors and these are two different products. Ratings are subjective opinions issued by contractors, while TransRisk is an algorithm based on a large number of factors, and the most important of them are the company's payment habits.